MSQ-The total overhead variance is A. Schedule Variance Index is 1.

Variance Analysis Learn How To Calculate And Analyze Variances

Its variable cost is 12 per unit and its fixed cost per unit is 8.

. A budget report is prepared to show how actual results compare to the budgeted numbers. A a sales price cost or quantity that is expected under normal conditions B costs incurred to produce a product C budgeted amount for total product cost D actual sales price cost or quantity Answer. Include factors that were important to your forecasting such as.

Budget variance deals with a companys accounting discrepancies. Which of the following statements about budgeting is not correct. All organizations use annual budgets but most also use quarterly or more frequent budgets.

Try answering with an example of how you took into consideration the previous years budget when asked about how you forecast a budget. Determine labour rate variance and labour efficiency variance respectively. The difference between the overhead costs actually incurred and the overhead budgeted at the actual operating level.

If the Earned Value is equal to Actual Cost it means. If the actual expense incurred is greater than what the expense should have been as set forth in the flexible budget the variance is. Which of the following BEST describes a flexible budget.

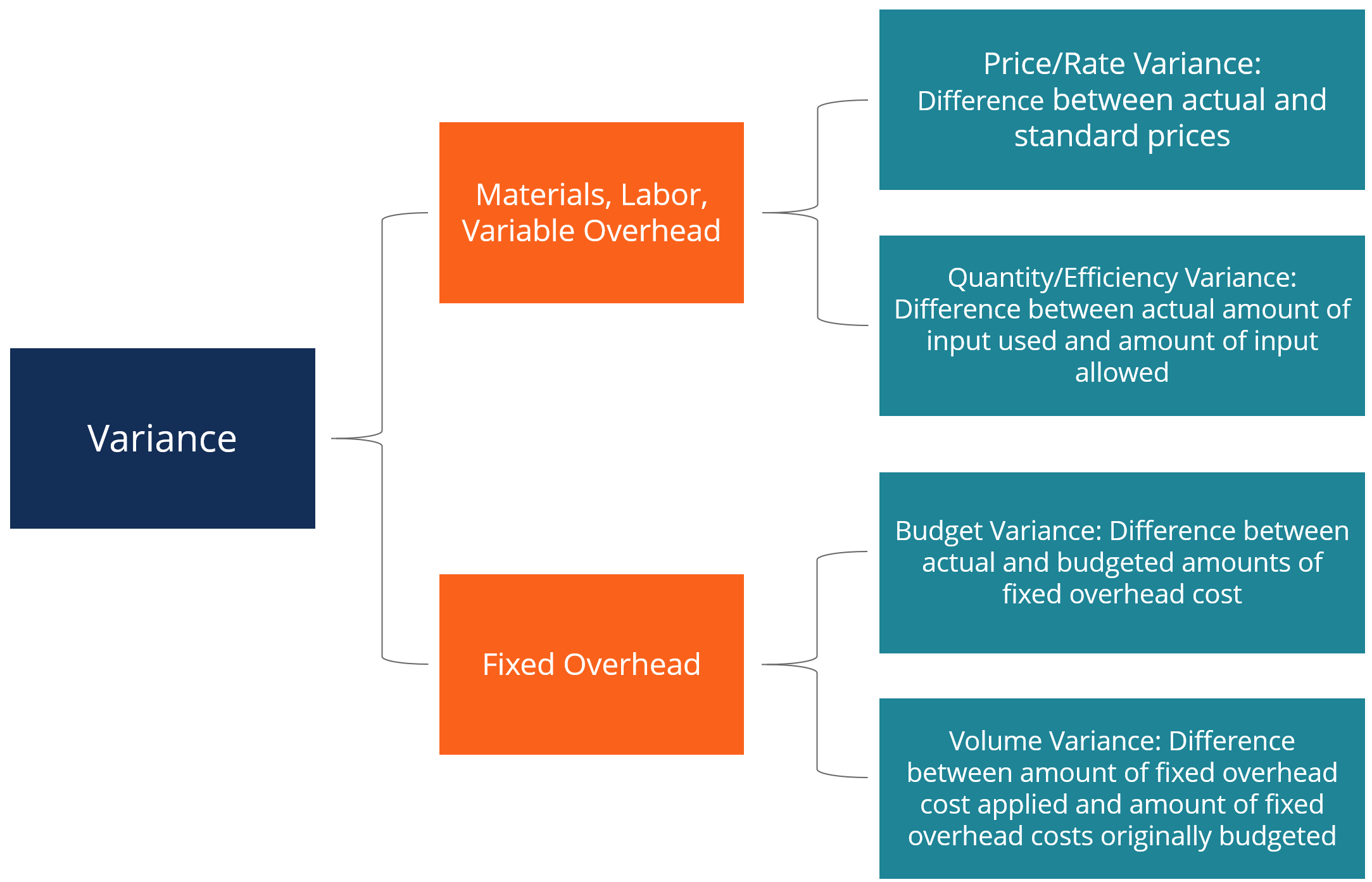

Cost Variance Actual Cost Standard Cost Actual Quantity Cost Variance Actual Cost - Standard Cost times Actual Quantity Cost Variance Actual Cost Standard Cost Actual Quantity Cost Variance Actual Cost - Standard Cost - Actual Quantity The direct material budget is prepared on the basis of. In zero-based budgeting the prior budget is adopted for the coming year with no changes. A Difference between actual amounts and the flexible budget due to differences in price and costs B Difference between the flexible budget and static budget due to differences in volumes C Difference between the static budget and actual amounts due to differences in price D Difference.

A budget that is updated halfway through the year to incorporate the actual results for the first half of the. The difference between actual and budgeted cost caused by the difference between the actual price per unit and the budgeted. Budget variances occur because.

Actual performance in cost period is production hours 10400 and idle time 400 hours. A favorable budget variance refers to positive variances or gains. 4 Which of the following statements best describes the earned value EV metric of variance at completion VAC.

The difference between actual overhead costs and budgeted overhead. Which of the following is the correct formula to measure cost variance. The negative variance can also sometimes refer to a discrepancy in budgeting for assets and.

There is no cost. A budget which shows sales revenue and costs at different levels of activity d. A a sales price cost or quantity that is expected under normal conditions.

A budget which shows variable production costs only b. The difference between the actual overhead incurred during a period and the standard overhead applied. On an income statement budget report think of how the variance affects net income and you will know if it is a favorable or unfavorable variance.

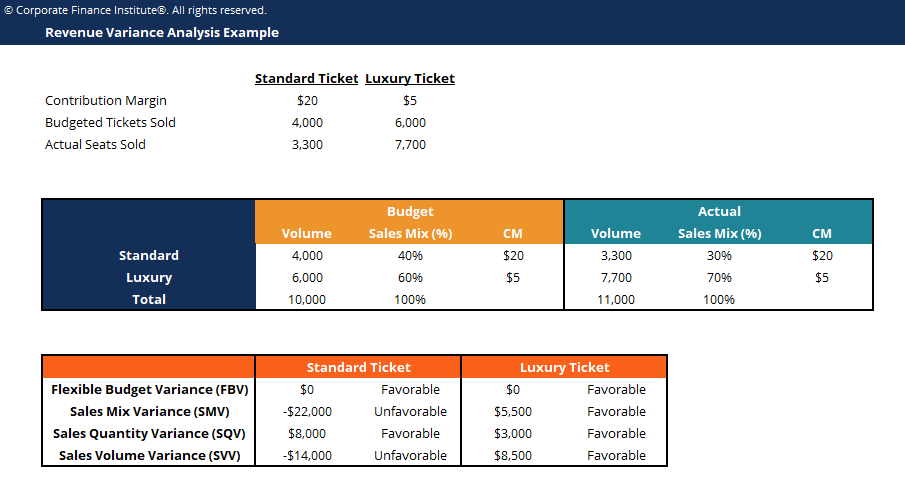

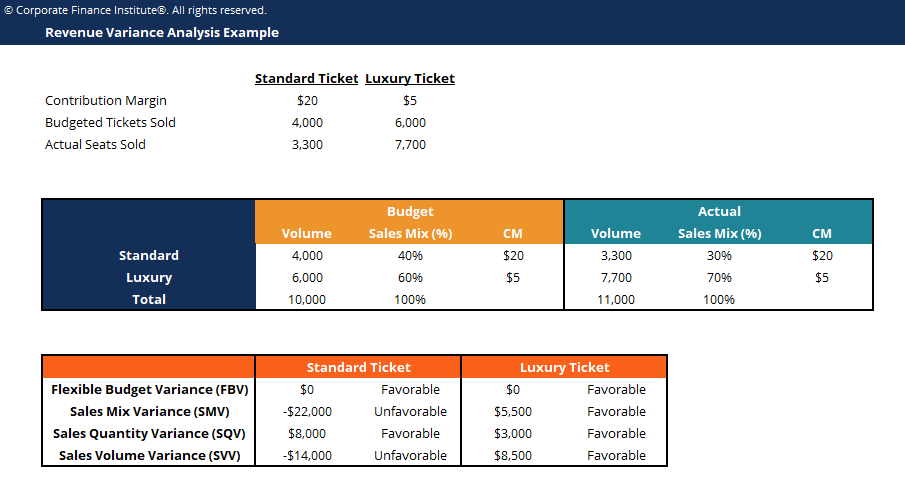

3 Given standard cost specifications time 5 hours per unit and cost Rs 5 per labour. An example is when a company fails to accurately budget for their expenses either for a given project or for total quarterly or annual expenses. If the actual total revenue is greater than what the total revenue should have been given the actual level of activity for the period the revenue variance is.

The term is most often used in conjunction with a negative scenario. Morgains president wants the Rubber Division to transfer 5000 units to another company division. Question 6 Which of the following best describes variance analysis.

When expenses estimated for the capacity attained differ from the actual expenses incurred the resulting balance is termed the A. 4 Which of the following best describes a standard. Which of the following best describes variance analysis.

An unfavorable budget variance describes negative variance indicating losses or shortfalls. The overhead cost variance is. D a quantifiable deviation away.

Payment done is average per hour Rs 520 for 10800 hours. Which one of the following best describes a benefit of budgeting. 232-2 Which of the following BEST describes sales volume variance.

A It provides the different business units across an organisation with a performance target b It acts as a communication tool c It can be used as a tool for motivating staff d All of the above. A contract with an unfavorable VAC at completion is forecasting a contract overrun. What term can BEST describe the difference of 5000.

Project is on budget and on schedule. A a retrospective study of what caused a difference between baseline and actual performance b a forecast of future performance focused on project costs and schedule c a deficiency in a project component that causes it to not meet its requirements or specification 5 5 5. There is no schedule variance.

A monthly budget which is changed to reflect the number of days in the month c. VAC is computed by subtracting the estimate at completion EAC from the budget at completion BAC. The Rubber Division of Morgain Company manufactures rubber moldings and sells them externally for 29.

When asked to describe your budget management experience always remain confident and make eye contact with the employer. In the conventional approach the prior budget is used as the starting point. It has columns for the actual and budgeted amounts and the differences or variances between these amounts.

Budget To Actual Variance Analysis In Fp A

This Video Is A Semi Short Explanation Of Flexible Budget Variance It S A Good Video To Watch Because Its A Brief Yet Detailed Cool Gifs Budgeting Flexibility

Variance Analysis Learn How To Calculate And Analyze Variances

0 Comments